The Art of Strip Mall Investment: Addressing Inefficiencies and Enhancing Value

Don Tepman, known as StripMallGuy, is an internet legend within the commercial real estate community on Twitter, boasting a significant following.

Consistently, day in and day out, he shares the most insightful and top-quality commercial real estate content on Twitter.

To the delight of everyone, he engaged in a 90-minute masterclass of real estate brilliance, which I found immensely helpful in providing clarity on various topics that have informed his approach, enabling him to raise $150 million in LP capital, yielding north of 20% returns year-over-year.

The Chris Powers does a great job in the interview highlighting several key points regarding the dynamics of the strip mall real estate market, focusing on inefficiencies, tenant relations, mentorship, and the impact of social media on business. Here are the primary takeaways:

Addressing Inefficiencies

1. Identifying Inefficiencies Early: The speaker emphasizes the importance of recognizing inefficiencies in a property from day one. This includes understanding current net operating income (NOI) and potential improvements.

2. Market vs. Actual Rent: A significant point made is the discrepancy between market rent and what tenants are currently paying. Often, long-term tenants pay below-market rates, and adjusting these can substantially increase a property's value.

3. Vacancy Management: Effective management of vacant spaces, including dividing large units and seeking suitable tenants, is crucial for maximizing income.

Tenant Relations

1. Fair Market Rent: Ensuring tenants pay market rent is not only fair for the landlord but also critical for sustaining viable businesses.

2. Tenant Viability: The speakers discuss the importance of tenants being able to thrive at market rents. If tenants are barely making a profit due to artificially low rents, it's risky for both the tenant and the landlord.

3. Understanding Tenant Business Models: By comprehending the business models and financials of tenants, landlords can make better leasing decisions. This includes evaluating tenants based on their revenue and appropriate rent-to-revenue ratios.

Mentorship and Learning

1. Role of Mentors: The podcast underscores the impact of mentorship in real estate. The speaker shares experiences of learning from mentors who provided not just business insights but life lessons as well.

2. Early Career Experiences: Learning through direct involvement, such as cold calling and sitting in on meetings, is highlighted as a critical aspect of gaining practical knowledge in real estate.

The Dynamics of Suburban Retail

1. Unchanging Fundamentals: Despite changes in the market, the basic principles of suburban retail—parking, signage, and co-tenancy—remain the same.

2. Parking and Visibility: Parking ratios and property visibility are key factors that influence the success of retail centers.

Social Media and Brand Building

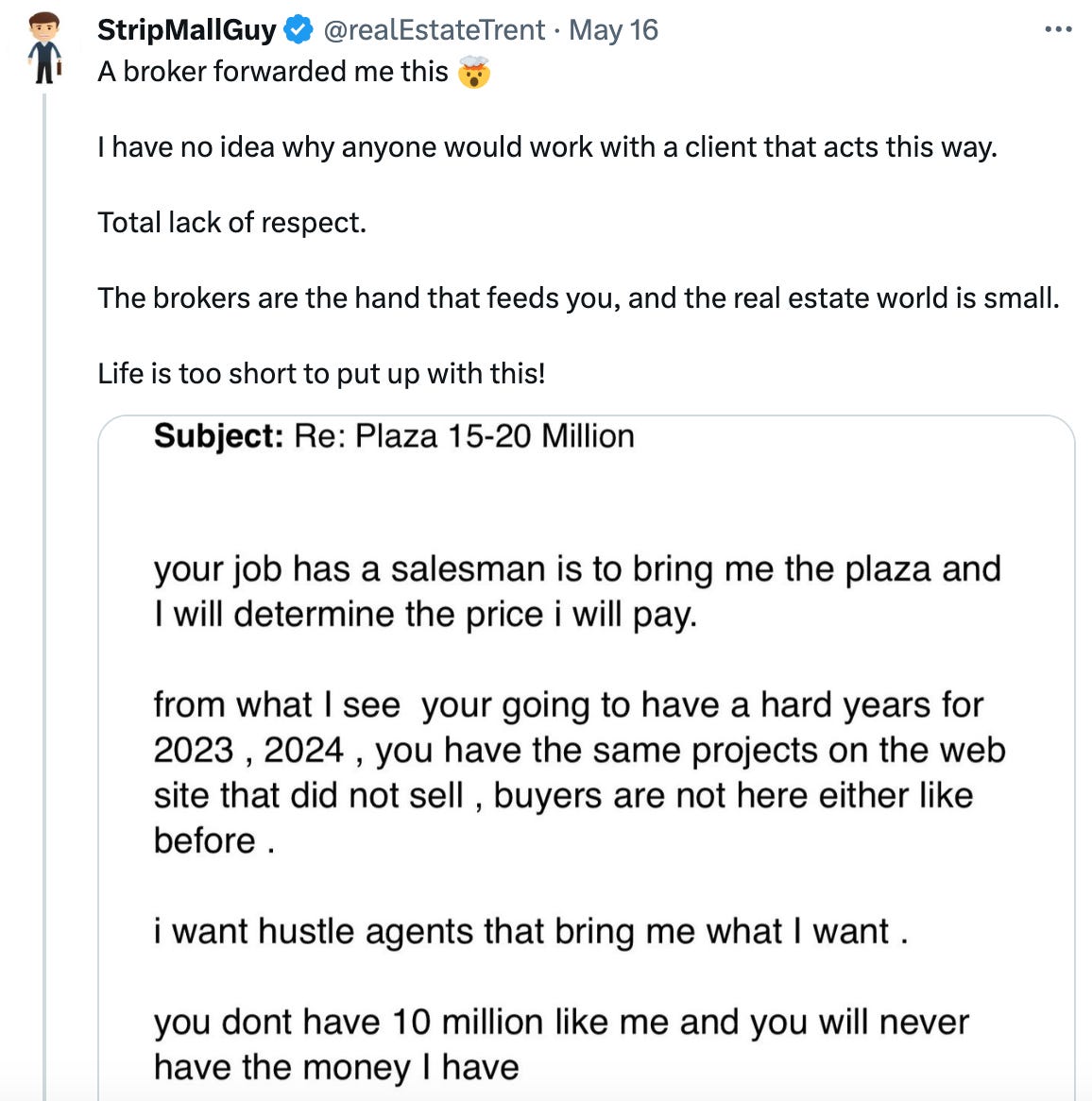

1. Impact of Social Media: The speaker discusses the unexpected benefits of using social media, particularly Twitter, to build a personal brand and expand business opportunities.

2. Networking and Deal Flow: Social media has facilitated connections with brokers and industry professionals nationwide, significantly increasing deal flow and business prospects.

The Challenges of Real Estate Investment

1. Environmental Concerns: Issues like environmental reports and managing properties with potential contamination are critical in making investment decisions.

2. Market Risk and Timing: The speaker emphasizes the importance of understanding market cycles and interest rates, advocating for selling properties at the right time to avoid losses.

Leasing Strategies

1. In-House Leasing: Conducting leasing in-house rather than relying on external brokers ensures more control and faster turnaround.

2. Proactive Approach: Actively canvassing for tenants and using tools like Yelp reviews to gauge tenant quality are effective strategies.

Holding Period and Exit Strategy

1. Fix and Sell Model: The speaker prefers a strategy of fixing inefficiencies in a property, increasing its value, and then selling it, rather than holding it long-term.

2. Market Conditions: Holding onto properties is seen as risky due to potential changes in market conditions and interest rates.

Personal Insights and Anecdotes

1. Charlie Munger's Advice: A notable anecdote is a meeting with Charlie Munger, where Munger advised on the importance of a buy-and-hold strategy, providing deep insights into long-term wealth creation.

2. Life and Career Reflections: The speaker shares personal stories and reflections on their career, including the importance of passion and doing what one loves.

The podcast provides a comprehensive look at the strategies, challenges, and personal experiences involved in the strip mall real estate market, emphasizing the importance of addressing inefficiencies, maintaining fair tenant relations, leveraging social media for business growth, and carefully navigating market risks.

LA Fund Commentary: The most astute fund managers are making appearances on specialized yet profoundly influential podcasts and conferences to enhance their intellectual influence, draw capital, and solidify their position within the community. This isn't limited to venture capital but extends to realms like real estate, private credit, and any arena where attentive audiences can be found, building immediate rapport and credibility.